Bitcoin price usd prediction 2021 to 2040 Crypto market

Bitcoin Price Prediction: BTC/USD Reaches $60,000 Level #Bitcoin bitcoin price prediction 2023 - 2025 to 2040 bitcoin price prediction walletinvestor bitcoin price prediction october 2021 You win if you correctly guess the price of BTC.

Will it be higher or lower then $59,945 USD at 24 October 21:00 UTC?

Members can join duel with DUEL - BNB PCS LP Now

Event Finish:24th October 21:00 UTC

Bitcoin price usd prediction

It has been a bearish morning.

Bitcoin price usd prediction

It has been a bearish morning.

Polkadot led the way down, sliding by 5.09%.

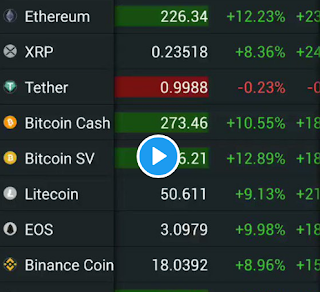

Binance Coin (-2.66%), Bitcoin Cash SV (-1.00%), Chainlink (-0.95%), Crypto.com Coin (-1.53%), and Ripple’s XRP (-1.24%) weren’t far behind.

Cardano’s ADA (-0.50%), Ethereum (-0.18%), and Litecoin (-0.56%) also saw red, however.

Through the early hours, the crypto total market cap fell to an early morning low $2,385bn before rising to a high $2,477bn. At the time of writing, the total market cap stood at $2,441bn.

Bitcoin’s dominance fell to an early morning low 44.74% before rising to a high 45.96%. At the time of writing, Bitcoin’s dominance stood at 45.81%.

Bitcoin would need to avoid a fall back through the second major resistance level at $59,199 to bring $60,000 back into play.

Support from the broader market will be needed, however, for Bitcoin to avoid sub-$59,000.

Barring a broad-based crypto rally, the resistance at the morning high $60,000 would likely cap any upside.

In the event of another extended rally through the afternoon, Bitcoin could test resistance at the third major resistance level at $60,832.

A fall through the major resistance levels and the $57,566 pivot would bring the first major support level at $56,643 into play.

Barring an extended sell-off through the afternoon, however, Bitcoin should avoid sub-$56,000 support levels. The second major support level sits at $55,933.

Looking beyond the support and resistance levels, we saw the 50 EMA pull away from the 100 and 200 EMAs through the morning.

We also saw the 100 EMA pull away from the 200 EMA delivering further support.

Through the 2nd half of the day, a further widening of the 50 EMA from the 100 would bring $61,000 levels into play.

Key through the late morning and early afternoon, however, would be to avoid a fall back through to sub-$59,000…